Mortgages

Whether you're a first-time home buyer or just need mortgage advice, we can help.

No two households’ financial needs are the same. You can trust that Community Credit Union is going to give you honest advice tailored to your specific financial situation. You will walk away with a plan to get you on the right path toward managing your mortgage and savings goals for the future. Check out our helpful mortgage calculator to determine how much you can borrow, estimate your mortgage payment, compare scenarios, and to see which mortgage product is right for you. Buying your first home?

Check out our Guide to Homebuying for information designed specifically for you.

For homeownership tips and advice, check out our mortgage articles on honestmoney.ca.

For honest advice when it comes to buying a home, book an appointment with one of our mortgage experts.

*On approved credit. Certain terms and conditions apply. 5-year fixed rate.

Mortgage Options

Community Credit Union has a mortgage product to meet your needs.

Community Credit Union offers First Time Home Buyers Mortgage (CMHC insured), Conventional Mortgages, Collateral Mortgages and Pre Approved Mortgages

First Time Home Buyers (CMHC insured) require 5% down payment, application fee and the funds to cover closing costs. (i.e.: legal fees, deed transfer, oil top up, etc.)

Conventional Mortgages or Collateral Mortgages require 25% down. The borrowed amount cannot exceed 75% of the purchase price or the appraised value, whichever is less.

Pre Approved Mortgages are approved based on the verbal information provided by you and are subject to verification of information prior to disbursement.

Amortization periods available from 1-25 years, with interest rates open for 1 year or closed for terms of 6 months, 1,2,3,4, & 5 years. Payments may be made weekly, bi-weekly, bi-monthly or monthly. Pre payment terms are also available consisting of doubling you regular payments &/or the privilege of applying 20% of the outstanding balance at anytime throughout the year.Our terms are flexible and made to suit your needs.

Certain conditions apply. Please contact our branch in Amherst or Truro to set up an appointment today.

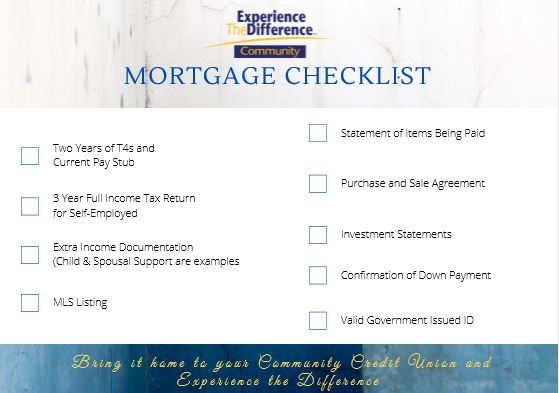

To better serve you, we ask that you bring the following information into your appointment.